Maximize Your Energy Savings with Broan-NuTone®

September 9th, 2024 | Broan-NuTone

Whether you’re a single-family home builder or contractor, if you’re not building to new ENERGY STAR v3.2 requirements, you may be missing out on significant Tax Credits.

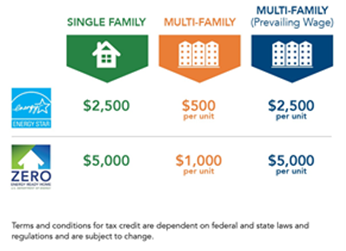

The Inflation Reduction Act revised and extended the 45L Energy Efficient Tax Credit with the intent to reward builders striving to deliver more energy-efficient homes. The tax credit is now specifically tied to certification to an eligible version of the relevant ENERGY STAR program or Zero Energy Ready requirements. This presents an excellent opportunity for single-family builders and contractors to optimize their projects for energy savings and financial benefits.

Understanding the ENERGY STAR v3.2 and the 45L Tax Credit

Here’s what you need to know about the new requirements and how Broan-NuTon can help you navigate these changes effectively. The 45L Tax Credit has been a valuable incentive for constructing energy-efficient single and multi-family homes. Getting ahead and planning for this program update now ensures that you can qualify for the tax credit for years to come.Here’s what makes ENERGY STAR v.3.2 different:

.png)

- Transition date: Beginning January 1, 2025, 47 states will transition from ENERGY STAR v3.1 to v3.2 requirements to be eligible for the 45L Tax Credit.

- Lowering HERS® Score target: On average, the target HERS Score needs be lowered by 10 points when transitioning from v3.1 to v3.2.

- ENERGY STAR v3.1 had a typical score range of 65-55; v3.2 falls within the range of 55-45 points.

- Tax credit based on acquisition date: Homes built and completed but not sold or leased until after January 1,2025 must comply with ENERGY STAR v3.2 to be eligible for the 45L Tax Credit.

Since every plan is unique, it is important to ensure your products are modeled properly to receive the maximum tax credit. We work with reputable energy modeling and rating firms across North America to evaluate the benefits of ventilation strategies to meet your application needs and achieve the HERS SCORE target.

Earn Tax Incentives with Ventilation Solutions That Meet ENERGY STAR® Requirements

As the industry leader in indoor air quality, we offer the most energy-efficient and innovative premium ventilation solutions for the home that bring new meaning to indoor air quality.

we offer the most energy-efficient and innovative premium ventilation solutions for the home that bring new meaning to indoor air quality.Choosing Broan® ERVs and EVOLVE exhaust fans can make a significant difference in meeting the new HERS targets, ensuring your projects are both energy-efficient and eligible for valuable tax credits. These products are designed to help you lower you’re HERS® Score from 2-6 points*.

*Based on energy modeling and analysis conducted by Broan with climate zones 2A and 6A.

For more information on how Broan-NuTone® can help you achieve these goals, visit our ENERGY STAR v3.2 information page.

The 45L energy efficiency tax credit is governed by an Internal Revenue Service tax code. You can learn more here. Check with your tax consultant for tax advice and to fully ensure you are meeting the requirements of this tax code.

English

English

English

English